Research - 18.08.2023 - 10:00

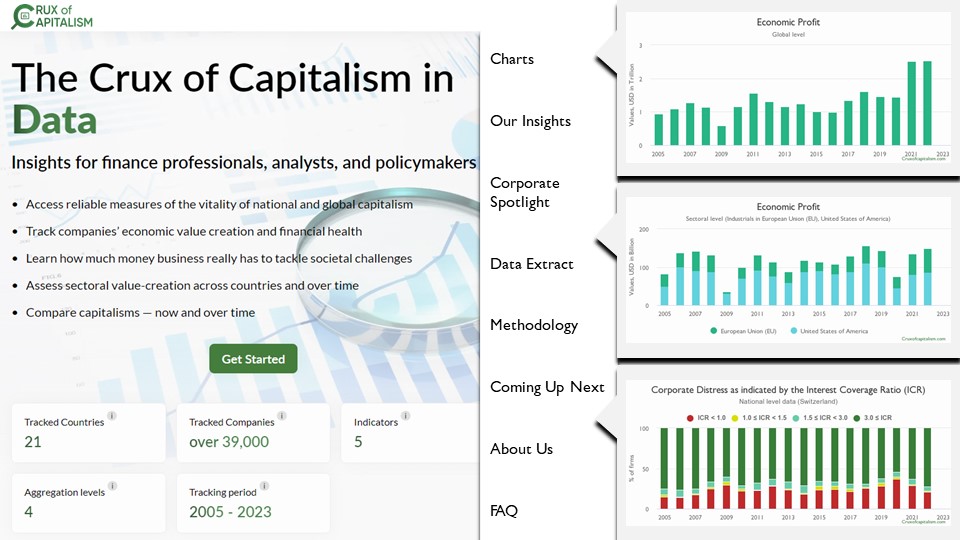

Crux of Capitalism Initiative examines the economic health of publicly listed firms

A new approach to measuring economic health led by University of St.Gallen Professor and Global Trade Alert Founder Simon Evenett.

Eine starke Wirtschaft basiert auf erfolgreichen Unternehmen. Ein neuer Ansatz misst die wirtschaftliche Gesundheit von zehntausenden börsennotierten Unternehmen. Simon Evenett, Professor an der Universität St.Gallen und Gründer von Global Trade Alert leitet das Projekt.

Firms can hide poor performance by adjusting their financial statements. Often policymakers and the public can’t see the connection between large measures like Gross Domestic Product and the performance of firms on the ground. The Crux of Capitalism Initiative (CoC) has developed a new way of looking at the robustness of the overall economy by delving into the true economic health of publicly listed firms.

Evenett, along with University of St.Gallen researchers Camilla Erencin and Felix Reitz, addresses two distinct knowledge gaps found in economy-wide assessments of corporate performance: 1) True economic profit generation and 2) Indicators of whether firms are in trouble – so called corporate distress, including indicators of whether a firm is becoming a “zombie.”

First focus: Economic profit generation – an overlooked metric

Currently, there is no approach that systematically compares economic value creation across firms, sectors, and nations. Some existing measures of economic vitality are based on future expectations (such as share prices) but investor sentiment is notoriously fickle. Gross Domestic Product (GDP) is a standard tool but the direct link to corporate performance is lost in national income accounting. And the data is often significantly revised after being published with a long lag. Simon Evenett argues “policymakers need a national measure of economic dynamism better rooted in actual firm performance, rather than surveys, investor sentiment, and indexes of the ease of doing business.”

The leading firms globally

CoC looks at over 39 000 of the largest firms based in 21 economically significant countries (most of the G20 as well as successful European nations, such as Switzerland). These 21 economies account for 78% of global GDP.

The CoC reports estimates of economic value added. This approach provides a more accurate picture of a company’s health because it accounts for both current operational performance and the use of shareholders’ capital. (In contrast, accounting profit can be flattered by different adjustments). Summed up, “national economic profit provides a novel way to track how well an economies’ leading firms are actually doing,” remarked Evenett.

Comparing across nations, the United States remains the powerhouse of value creation in the world economy – accounting for about 53% of total economic profit in the 21 economies tracked in the CoC project (in 2022). In contrast, Chinese firms only really started creating a combined value of over $100 billion from 2019. In 2022 publicly listed Chinese firms made $185 billion in economic profit (~9% of total economic profit in 2022). However, because there are so many Chinese firms, the average Chinese publicly listed firm made less than $5 million in surplus once the true cost of capital deployed was taken into account.

With regular updates, the CoC project allows users to track developments over time. The toll of higher interest rates, greater geopolitical rivalry (including conflict), and other worsening drivers of the global economy over the past 18 months is now apparent. The first quarter of 2022 saw global economic profit levels exceed $690 billion. The data in so far for Q1 2023 imply that global economic profits have fallen at least a third over the past 12 months.

Interactive, data-driven website

This data is presented in a user-friendly, high-quality and interactive website. This data is available to journalists, academics and the general public and will be updated regularly. Thought Leadership articles dissecting and analyzing global trends, and upcoming challenges will be produced using the CoC metrics. These pieces will offer detailed analyses of particular research questions on corporate distress and value creation and will look at the world through an economic profit lens.

Second focus: Corporate distress

As interest rates “normalize” after a decade of quantitative easing, how many more firms will go into corporate distress? Traditionally, analysts have looked at individual firm’s ability to repay interest on their loans. Others have prepared metrics of the likelihood of bankruptcy. For the first time, the Crux of Capitalism website will track both metrics at the firm, sectoral, national, and global levels. Tracking the extent of corporate distress is now much easier. “The bigger picture is no longer lost in the weeds of company detail,” Camilla Erencin observed.

Firms that cannot pay their debts cannot be expected to be in business for the long haul. Often the term “zombie firm” has been used to describe firms that face medium to long term financial problems. Most analyses treat zombie firm status as a binary label – a firm is or it isn’t. This is unfortunate as much can be learned from how comfortably the firms are paying their financial commitments – shedding light on whether they have room to absorb higher interest rates.

Felix Reitz worries that leading firms won’t be able to sustain profit levels seen in 2022. He argues that “the real test for leading global firms is whether they can maintain profitability as interest rates rise, geopolitical tensions result in uncertainty and protectionism, especially now that that COVID-related government stimulus is wearing off. Business models built for yesterday are going to be tested against a worsening global business environment.”

Compared to Q1 2022, the United States and the European Union have seen a 3.5 percentage point increase in the number of publicly listed firms at risk of bankruptcy. US firms able to comfortably pay interest on their debts have fallen 3 percentage points over the same time frame. By contrast, two percent fewer Japanese publicly listed companies reported that could not pay its interest charges out of current operating profits.

Worse off, the percentage of firms from the BRICS economies failing to cover their interest payments rose four and a half percentage points from Q1 2022 to Q1 2023. The impact of recent global economic developments is unevenly felt across the world’s major firms.

The Crux of Capitalism Initiative was launched at a joint University of St.Gallen and Swiss National Bank Workshop held on 7 July 2023. This project is developed for analytical purposes and does not provide investment advice.

To receive Thought Leadership insights and project updates please contact cruxofcapitalism(at)outlook.com.

The Crux of Capitalism Initiative has been developed by Professor Simon Evenett and researchers Camilla Erencin and Felix Reitz.

Image: Adobe Stock / peshkova

More articles from the same category

This could also be of interest to you

Discover our special topics