Throughout the entire MiQE/F programme, you will be equipped with the necessary tools to apply quantitative methods in quantitative economics and finance. At the University of St.Gallen (HSG), the integration of functional knowledge for the major economic, econometric and social challenges of our time is at the center of all thought and action.

As a MiQE/F student, you develop a deep understanding of economic and financial theories. Given the challenges and increasing importance of digitalisation, MiQE/F offers courses on big data, machine learning and related topics for successful careers in the digital age. MiQE/F graduates develop five core competencies as part of their studies.

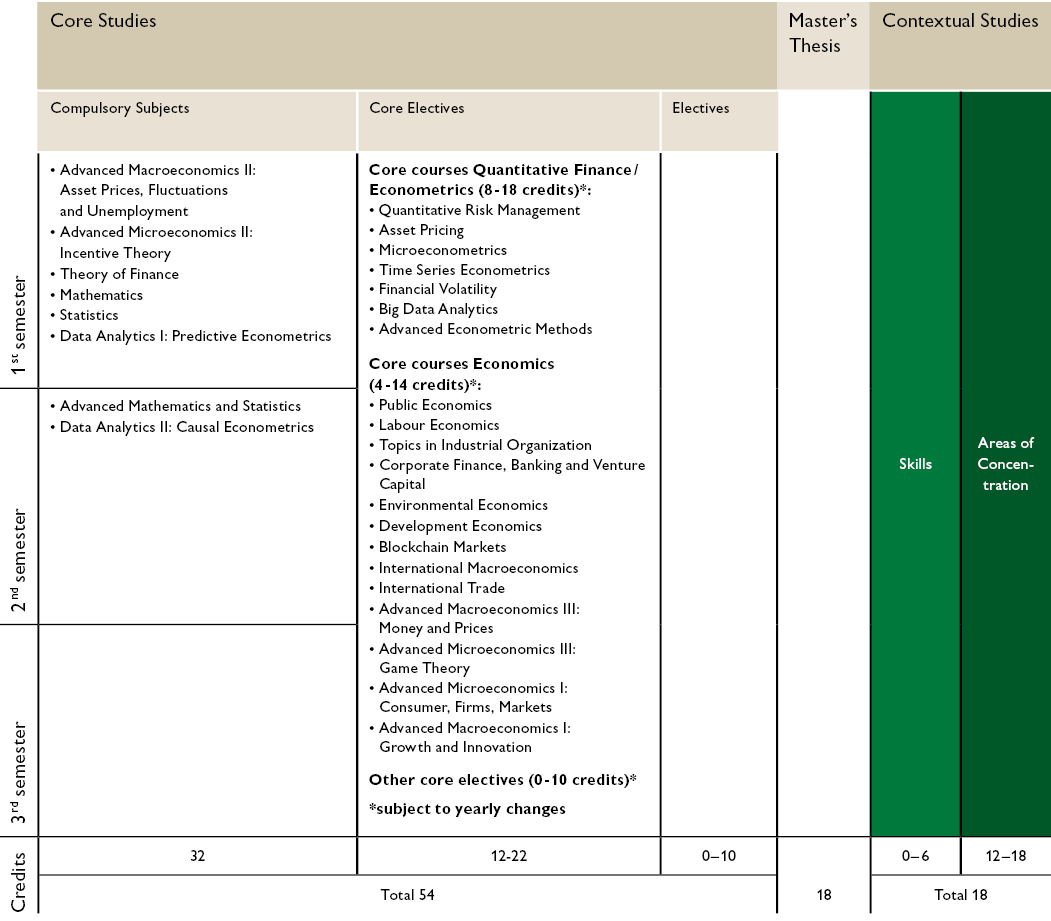

Our compulsory area covers the central topics of Micro- and Macroeconomics, Data Analytics, Theory of Finance, Mathematics and Statistics.

In the context of economic challenges, topics such as the major economic and social challenges of our time require a holistic understanding of the economy as a whole. Based on these rigorous foundations, students subsequently choose their core and independent electives.

By choosing at least two courses (8-18 ECTS) in the core area of Quantitative Finance/Econometrics and at least one course (4-14 ECTS) in the core area of Economics, the degree programme covers the context of economic and financial challenges. The other core electives area complete the course offering. While subject-specific skills in the areas of finance, econometrics, quantitative methods and economics are trained in the core studies, the Contextual Studies focuses on the development of social and cultural skills.

Furthermore, additional qualifications such as «FinTech», «Real Estate», «Business Education», «Digital Communication and Journalism» and «Managing Climate Solutions» are offered.

The core studies MiQE/F consist of the compulsory area and the core electives area. The compulsory subjects give you a clear profile. In two semesters, you will gain a unique academic education in the core disciplines of economics, finance and method courses. In addition, you gain valuable insights into current economic and finance topics and you learn how to analyse and deal with large amounts of data.

The compulsory area comprises a total of eight courses adding up to 32 ECTS credits, two in the core disciplines of micro- and macroeconomics, two in econometrics, three in mathematics/atatistics and one in Finance.

| Course | ECTS | Semester |

| 7,254 Advanced Macroeconomics II: Asset Prices, Fluctuations and Unemployment | 4 | Autumn |

| 7,256 Advanced Microeconomics II: Incentive Theory | 4 | Autumn |

| 7,300 Mathematics | 4 | Autumn |

| 7,305 Statistics | 4 | Autumn |

| 7,310 Data Analytics I: Predictive Econometrics | 4 | Autumn |

| 7,315 Theory of Finance | 4 | Autumn |

| 8,300 Data Analytics II: Causal Econometrics | 4 | Spring |

| 8,302 Advanced Mathematics and Statistics | 4 | Spring |

You can find the entire course offering and the course factsheets in the official Course Catalogue Online.

Aufbauend auf dem Pflichtbereich können Sie im Rahmen des Pflichtwahlbereichs (12-22 ECTS-Credits) Ihr Studienprofil weiter schärfen, Ihre individuellen Interessen vertiefen und so Ihre volkswirtschaftliche und finanzmathematische Perspektive erweitern.

Der Pflichtwahlbereich des MiQE/F ist in zwei Schwerpunktbereiche unterteilt "Core Courses Quantitative Finance/Econometrics" und "Core Courses Economics". Im übrigen Pflichtwahlbereich bieten wir Ihnen weitere Kurse mit einem volks- und finanzwirtschaftlichen Bezug an.

| I: Core Courses Quantitative Finance/Econometrics | II: Core Courses Economics | III: Other Core Electives |

|---|---|---|

| 8-18 ECTS credits | 4-14 ECTS credits | 0-10 ECTS credits |

Es müssen mindestens 2 Kurse aus diesem Bereich gewählt werden; zusätzliche Kurse werden im übrigen Pflichtwahlbereich angerechnet. | Es muss mindestens 1 Kurs aus diesem Bereich gewählt werden; zusätzliche Kurse werden im übrigen Pflichtwahlbereich angerechnet. | Sie können entweder einen weiteren Schwerpunktkurs belegen oder aus einem breiten Angebot von Kursen aus dem übrigen Pflichtwahbereich wählen. |

Im Schwerpunktbereich Quantitative Finance/Econometrics müssen Sie mindestens 8 ECTS-Credits (2 Kurse) wählen. Bis zu 18 ECTS-Credits sind möglich.

| Kurs | Semester |

| 7,320 Quantitative Risk Management | Autumn |

| 9,272 Big Data Analytics | Autumn |

| 9,332 Advanced Econometric Methods | Autumn |

| 9,334 Quantive Behavioural Finance | Autumn |

| 8,310 Asset Pricing | Spring |

| 8,312 Microeconometrics | Spring |

| 8,314 Time Series Econometrics | Spring |

| 8,318 Financial Volatility | Spring |

Im Schwerpunktbereich Economics müssen Sie mindestens 4 ECTS-Credits (1 Kurs) wählen. Bis zu 14 ECTS-Credits sind möglich. Zusätzliche Kurse werden den Other Core Electives angerechnet.

| Kurs | Semester |

| 7,250 Advanced Macroeconomics I: Growth and Innovation | Autumn |

| 7,252 Advanced Microeconomics I: Consumer, Firms, Markets | Autumn |

| 7,260 Topics in Industrial Organization | Autumn |

| 8,250 Advanced Microeconomics III: Game Theory | Spring |

| 8,252 Advanced Macroeconomics III: Money and Prices | Spring |

| 8,260 Public Policy, Taxation and Inequality | Spring |

| 8,264 International Trade | Spring |

| 8,270 International Marcoeconomics (MEcon) | Spring |

| 8.272 Labor Economics | Spring |

| 8,274 Corporate Finance, Banking and Venture Capital | Spring |

| 8,278 Environmental Economics | Spring |

| 8,284 Development Economics: Past and Present | Spring |

| 8,288 Blockchain Markets | Spring |

Aufbauend auf dem Fundament der Pflichtkurse können Sie entweder einen weiteren Schwerpunktkurs (Quantitative Finance/Econometrics oder Economics) belegen oder aus einem einem breiten Angebot an Other Core Electives Kursen wählen und so Ihr akademisches Profil weiter schärfen, Ihre individuellen Interessen vertiefen und Ihr ökonomisches Wissen erweitern.

Im MiQE/F-Programm der Universität St.Gallen bieten wir Ihnen sowohl im Schwerpunkt- als auch im übrigen Pflichtwahlbereich Kurse an. Im Wahlbereich haben Sie die Möglichkeit, Kurse aus verschiedenen Themenbereichen zu besuchen.

| Kurs | Semester |

| 7,162 Financial Programming with Matlab | Autumn |

| 7,172 Digital Capital Markets | Autumn |

| 7,264 Data Handling: Databases | Autumn |

| 7,322 Quantitative Asset Management | Autumn |

| 7,395 Consultancy Project: Energy in Transition - Challenges and Opportunities in the Gulf Region | Autumn |

| 7,396 Consultancy Project: Economic Crisis and Crisis Management | Autumn |

| 9,164 Fixed Income Instruments | Autumn |

| 9,168 Theory of Risk and Insurance | Autumn |

| 9,264 Recent long-run Macroeconomic Trends | Autumn |

| 9,268 Political Economics | Autumn |

| 9,334 Quantitative Behavioral Finance | Autumn |

| 8,151 Asset Allocation and Investment Strategy | Spring |

| 8,152 Derivatives | Spring |

| 8,154 Financial Econometrics | Spring |

| 8,172 Real Estate Finance | Spring |

| 8,174 Applied Quantitative Asset Management | Spring |

| 8,194 Derivatives Modeling in Python | Spring |

| 8,256 The Economics of Strategy | Spring |

| 8,266 Economics of Central Banking | Spring |

| 8,273 Advanced Tools in Data Analytics | Spring |

| 8,275 Economics in Healthcare | Spring |

| 8,280 Beyond Homo Oeconomicus: Decision Making and Wellbeing in Economics | Spring |

| 8,282 Asset-Liability Management für Schweizer Pensionskassen | Spring |

| 8,286 Selected Topics in Swiss Public Finance | Spring |

| 8,320 AI for Decision Making | Spring |

| 8,330 Machine Learning (MiQE/F) | Spring |

Im Online Vorlesungsverzeichnis finden Sie das aktuelle Kursangebot sowie die Kursbeschreibungen.

Many of our MiQE/F students choose to spend their third semester at one of our partner universities all over the world. During the semester abroad, they can transfer up to 18 ECTS credits, and more importantly, acquire intercultural competencies without having to interrupt their studies.

Additionally, students have the opportunity to pursue a double degree through the prestigious CEMS programme. Selected students can earn two Master’s degrees in a short period of time, giving them a competitive advantage in the global job market. CEMS is ranked among the top programmes globally, consistently holding 9th place in the Financial Times worldwide rankings. It is essential to review the application criteria, particularly the language requirements, beforehand.

There is also the possibility of enhancing your knowledge and perspective with a double degree with ESADE, RSM, HEC Bocconi or SSE. Double degree students can take advantage of unique degree combinations and the possibility for in-depth study within different cultural contexts. At the conclusion of the double degree programme, usually 2.5 years, students will earn two full Master degrees, a HSG MA degree and a second Master from the partner university. Graduates enjoy the very best career opportunities and close ties to both the HSG and their host university.

The MiQE/F is distinguished by its international focus and can only be studied in English. Our students are thus excellently prepared for a career in English-speaking companies or organisations worldwide.

Here you will find a summary of the most important legal provisions in the Master’s degree programme.

The Contextual Studies programme is another unique feature of the University of St.Gallen (HSG). It integrates knowledge across disciplines and strengthens the social and cultural competencies of our students distinctively. Students take a holistic approach by "thinking outside the box" and enrol in courses within focus areas and skills areas. The cultural and social science offerings in the focus areas are highly diverse and aligned with the study programme. In the skills area, students acquire additional competencies and practical skills necessary for success in the business world. The Contextual Studies programme complements your main field of study and is awarded with 18 ECTS credits.