Our curriculum

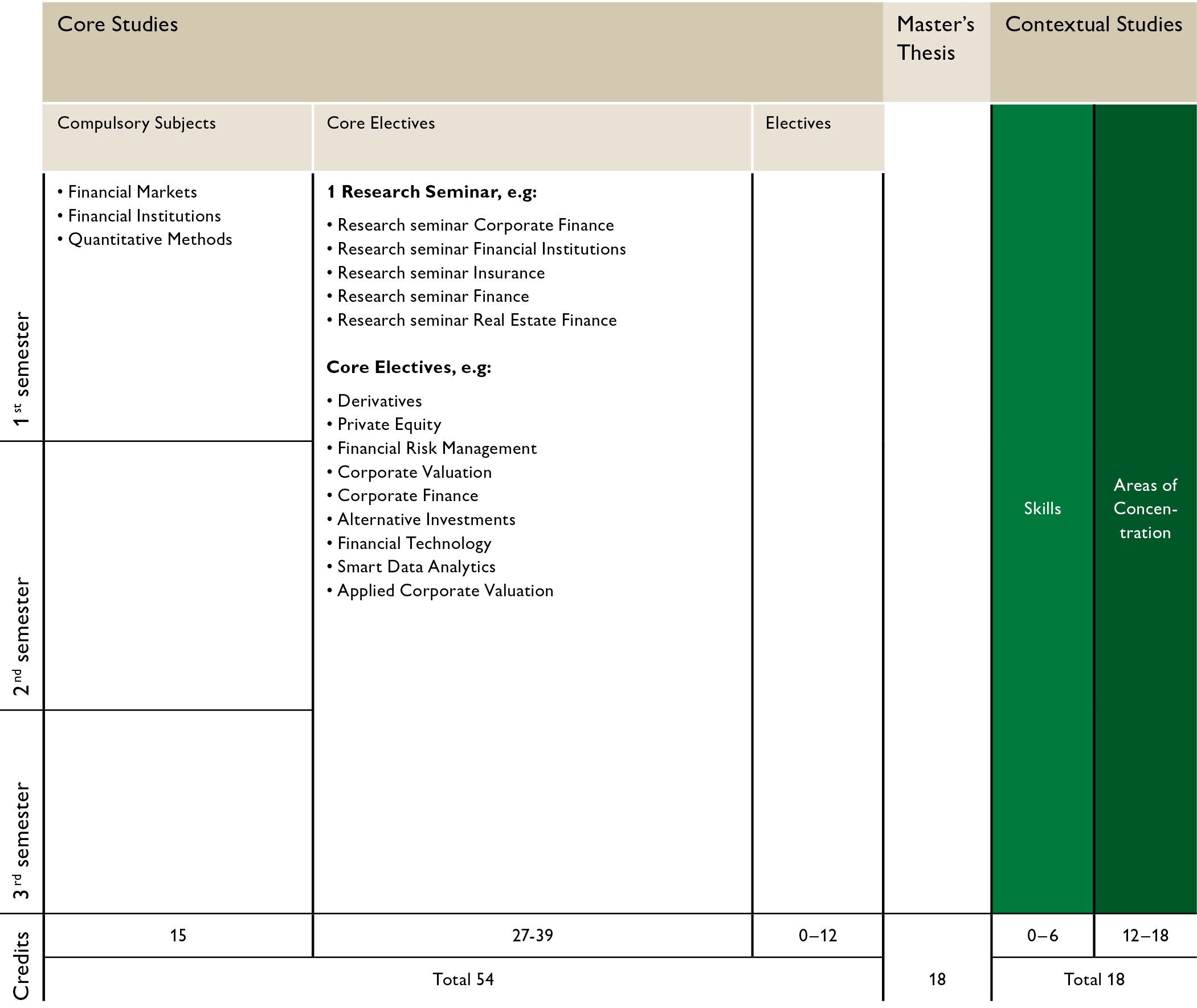

The MBF programme has a clear and flexible course structure. The core studies are made up of three compulsory courses and a broad choice of electives

The MBF program is structured in such a way as to ensure that students are able to acquire their basic knowledge in the compulsory courses of the first semester. In the second and third semesters, students select core electives and contextual courses according to their individual preferences and thus determine the orientation of their studies themselves. Like this, the MBF curriculum guarantees utmost flexibility and freedom of choice.

Duration: 1.5 years / 3 semesters (full-time)

Credits: 90 ECTS

The compulsory "MBF Integration Days" last several days and take place at the beginning of September (calendar week 36).

The MBF Integration Days are an exclusive series of sessions which will prepare you for the MBF programme and include among others an international team building event and several finance and banking related presentations. You can start your Master's degree only once you have successfully completed the MBF Integration Days.

In the first semester, students attend the compulsory courses Financial Markets, Financial Institutions and Quantitative Methods. These challenging courses allow the students to develop the fundamentals in finance, allowing them to further tackle the other specialised courses and the empirical Master’s thesis.

| Course | ECTS | Lecturer | Language | Semester |

| 7,150 Financial Markets | 5 | Prof. Dr. Manuel Ammann | EN | Autumn |

| 7,155 Financial Institutions | 5 | Prof. Dr. Anastasia Kartasheva | EN | Autumn |

| 7,160 Quantitative Methods | 5 | Prof. Dr. Angelo Ranaldo | EN | Autumn |

This course offering corresponds to the current planning status. You can find the entire course offering in the official Course Catalogue Online.

Throughout the programme, students may design their individual curriculum according to their preferences. They can freely combine courses from an extensive list of core electives grouped in the focus areas of Financial Markets, Banking & the Financial Economy, Corporate Finance, Alternative Investments, Risk Management & Insurance and Quantitative Methods & Data Science. It is also possible to obtain a Diploma Supplement in one of the above-mentioned areas, when a student completes at least 12 ECTS and the Master’s thesis in the corresponding subject track. The wide selection of courses and the flexibility of the curriculum make the MBF programme particularly attractive.

You can find the entire course offering in the official Course Catalogue Online.

Our students have the possibility to concentrate on one subject track during their studies. To receive a Diploma Supplement of Subject Track, the student has to take min. of 12 ECTS in Subject Track + write the Master's thesis in Subject Track. Please note, that the mandatory courses "Financial Markets", "Financial Institutions", and "Quantitative Methods" do not count towards the subject track. However, it is always possible to freely choose and combine courses from different subject tracks.

Alternative Investments |

|

|

|

|

Banking & the Financial Economy |

|

|

|

|

Corporate Finance |

|

|

|

|

Financial Markets |

|

|

|

|

Quantitative Methods & Data Science |

|

|

|

|

Risk Management & Insurance |

|

|

|

|

The research seminar is a 3 ECTS course, available in the spring semester, where the students are required to write a paper with a particular research focus. All groups present and discuss their main findings with the class. In combination with the Master’s thesis, the MBF therefore provides a thorough preparation for a Ph.D.

Independent electives create additional choices, where students may either attend further core electives of the MBF or courses of other Master’s programmes.

You can find the entire course offering in the official Course Catalogue Online.