Opinions - 02.04.2020 - 00:00

2 April 2020. Supply chains are currently under permanent stress worldwide – Switzerland not excluded. Like never before in times of peace, they are currently having to prove what they are capable of achieving. And – the positive aspect – supply chain managers and their operation units are providing evidence of their adaptability in an impressive manner at present; in spite of all the adversities of the crisis, procurement and logistics are proving to be a crucial factor for Europe’s economic system, particularly in foodstuffs, pharmaceutical and medical technology. In these sectors, transport and storage services are indefatigably in international operation although activities can only be kept up with increasing lack of speed and difficulty. In other industries, such as the automotive, machine- and plant-building or high tech industries, dramatic interruptions of the supply chains are on the increase.

What role do procurement and logistics play in times of a pandemic?

Unfortunately, we only notice in difficult times – such as the current corona crisis – how important the good working order of the real goods economy is. The flow of goods is the lifeline of our economy. Logistics and procurement in the sense of the “supply economy” play a central role – in Switzerland, in Europe and worldwide. At present (late March 2020), the supply of vital pharmaceuticals, medical devices and means of protection has top priority, quickly followed by the supply of the population with necessary goods. Food producers, trade and the logistic services providers used for the purpose are currently operating in “Christmas mode”. All conceivable capacities are being raised at present. Online trade is booming as never before. Here, too, procurement and logistics are playing a central part. What happens when a supply chain is interrupted can be observed in other industries which are by now lacking important input goods and raw materials from abroad, which means that their production has been shut down.

Food producers, trade and the logistic services providers used for the purpose are currently operating in “Christmas mode”. All conceivable capacities are being raised at present.

Are there any current bottlenecks with foodstuffs, and could Switzerland be self-sufficient in the future?

In Switzerland we have so far been accustomed to being able to buy almost any product at any time of year. As yet, the shelves are still well stocked, and one-off shortages have only been registered owing to unusually high demand – toilet paper and yeast being cases in point. Generally, however, domestic products from Switzerland are less affected by supply bottlenecks than imported goods. Countries such as Vietnam, one of the biggest rice exporters, have imposed export restrictions on agricultural products. In Spain, from where Switzerland usually imports a great deal of fruit and vegetables, harvesters are staying at home owing to the current curfew. A similar situation is emerging with regard to the asparagus harvest in Germany. A lack of capacities in logistics, as well as a deceleration caused by hygiene and quarantine provisions, are additionally aggravating.

While the current corona crisis may be hampering the import of selected foodstuffs, there will still not be an exclusively regional supply in the future. However, dependencies will in future be reduced, for instance through redundant procurement sources (suppliers) and the establishment of stocks inasmuch as this is possible. However, every crisis also harbours an opportunity – thus consumers will regain an increasing awareness of regional foodstuffs from Switzerland. This would surely also have a positive aspect.

What are the current consequences for the supply chains?

There is no general answer to this question. A more differentiated perspective has to be assumed while mentioning that great work is being done in all sectors despite or because of the adverse circumstances.

What are the most critical points in the supply chain at present?

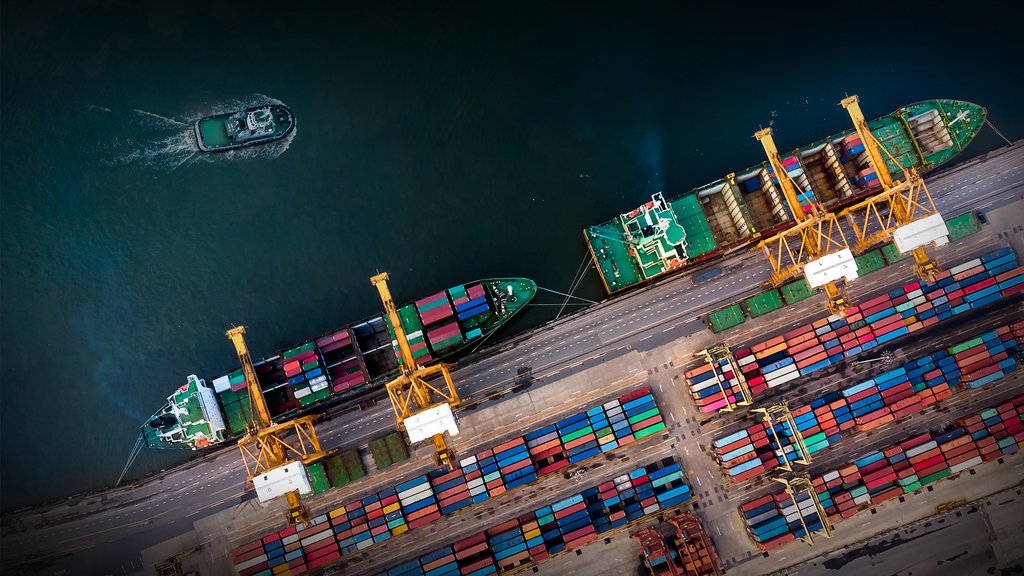

Most industries in Europe, and in Switzerland in particular, are strongly dependent on international supplier networks – pharmaceuticals, machine- and plant-building, the automotive industry, as well as electronics and watches being cases in point. Access to materials, components, parts and products must be safeguarded, bearing in mind that from a Swiss perspective, too, a large part of international trade runs through the North Sea ports, primarily Rotterdam and Hamburg. Although activities are continuing, current volumes are on the downturn (late March 2020).

The crisis is having an adverse effect on the availability of cash in all companies, and this might result in general delays in payment and breakdowns. This is why the issue of liquidity is particularly sensitive. The introduction of short-time work and the flexible deployment of staff may produce relief – at least in the short term.

The online channel is the only possibility for many companies to participate in economic life at present.

Owing to the enormous increase in mail order trade, post office and parcel delivery services must be safeguarded and the relevant processes must be maintained. After all, the online channel is the only possibility for many companies to participate in economic life at present.

Finally, care must be taken that the borders remain open at least for goods transport – border checks impair goods transport and thus the reliability of supply. In this respect, it is imperative that Switzerland should continue to deal with the European Union in a consensus-oriented manner.

What has gone wrong in the supply chains?

Procurement was predominantly controlled according to savings. In some places, this resulted in excessively lean supply chains. Worldwide division of labour across national borders may have made many products cheaper, but this made the supply chains more vulnerable to crises – as we can see now. Robustness and resilience have flown out of the window. In these processes, which have been configured for efficiency and just-in-time without interim storage or buffers, lorries work as so-called “warehouses-on-wheels”.

In some cases, this “leanness mania” has been exaggerated, and we are now exposed to the consequences. In the future, the purchasing, logistics and the finance departments must pool forces and jointly make decisions which safeguard the company’s supply. This includes the establishment of resilient supply chains, as well as forward-looking and anticipative supply chain planning. Companies must be acquainted with their entire supplier network (including the suppliers themselves).

By now, there are powerful mapping instruments for the creation of supply chain transparency, such as RiskMethods or Resilinc. It is imperative that in the future, stability and crisis prevention criteria will have to play a role in the assessment of suppliers, with the existence of a business plan having to be part of this. This will also include the contractual determination of expected restoration times and methods during such incidents.

What about state aid with regard to supply chains?

The general objective must be to prevent bankruptcies and the loss of jobs, and to ensure that companies will remain solvent and operational. Companies must be placed in a position where they will be able to continue where they left off before the crisis. Here, the current motto must be “No half measures!” The “corona aid packages” must reach those acutely in need quickly, particularly the small and medium-sized enterprises (SMEs).

Companies must be placed in a position where they will be able to continue where they left off before the crisis.

Fortunately, this is also the case. The turnovers of these numerous companies rarely exceed an average of CHF 200,000 per annum; thus CHF 10,000-15,000 a month are required by way of compensation. However, even if savings in variable expenses are taken into account, the immediate state aid that is being talked about will help for the next four to six weeks at best. Unfortunately, we do not know at this time how long the crisis will last. Also, the companies must be aware of the fact that they will have to repay the loans in the years to come. Many of the small and medium-sized entrepreneurs, however, have never negotiated a credit line with a bank before. The formalities and the bureaucracy that are connected with an application for funding to secure liquidity often overtax them. The point is to make these repayments as simple as possible.

The decision made by the Federal Council and the cantons to support SMEs was right! Quick financial aid for SMEs is more than appropriate – but it is not without risks. Not everyone and every company is “suddenly” creditworthy! This is where an enormous risk is lurking for the government and the taxpayer after the crisis – particularly if it should turn out that the debtors’ creditworthiness was not secured. This is why despite regulatory reservations, we should think about fixed-term government participation funds for small and medium-sized enterprises, for these would safeguard liquidity without any concrete repayment obligations.

Prof. Dr. Erik Hofmann is Director of the Institute of Supply Chain Management (ISCM-HSG).

Image: Adobe Stock / THATREE

More articles from the same category

This could also be of interest to you

Discover our special topics