In the fields of financial markets, financial institutions, corporate finance and quantitative methods, the M.A. HSG in Banking and Finance (MBF) offers high-quality education in both theory and practice. It prepares you for a successful career start with banks, consulting agencies, insurance companies and the finance departments of non-financial corporations, both in Switzerland and abroad.

The Master in Banking and Finance (MBF) programme at the University of St.Gallen develops strong analytical and quantitative skills essential for solving complex financial problems. Students gain deep expertise in areas such as asset management, corporate finance, and alternative investments while applying knowledge to real-world scenarios. The programme emphasizes research, cultural awareness, and effective communication, preparing graduates for successful careers in finance, consulting, or academia.

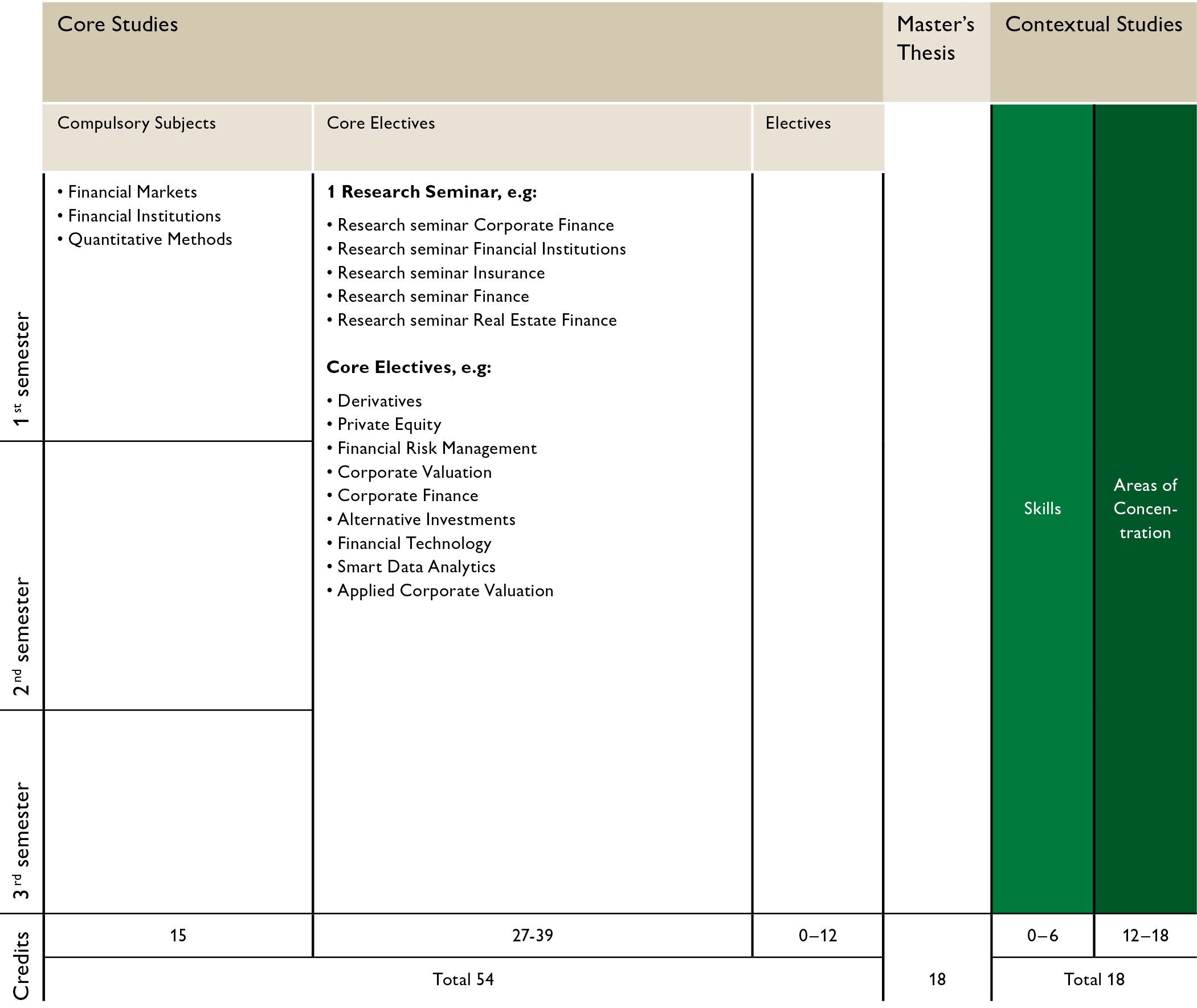

Through an integrative approach of theory and application, the MBF program aims to prepare the students for their ambitious professional careers in various industries. In addition to the three compulsory courses - Financial Markets, Financial Institutions and Quantitative Methods - the students have the possibility to choose from a broad range of elective courses, with subjects ranging from corporate finance and alternative investments to insurance management. The courses enable students to develop a strong analytical skill set and a deep understanding of financial concepts.

Furthermore, tailored events such as the MBF Integration Days, the MBF Research Retreat, the MBF Career Workshop Series and the Career Power Days, aim to foster the MBF community and offer great opportunities to develop effective practical skills.

The Contextual Studies programme is another unique feature of the University of St.Gallen (HSG). It integrates knowledge across disciplines and strengthens the social and cultural competencies of our students distinctively. Students take a holistic approach by "thinking outside the box" and enrol in courses within focus areas and skills areas. The cultural and social science offerings in the focus areas are highly diverse and aligned with the study programme. In the skills area, students acquire additional competencies and practical skills necessary for success in the business world. The Contextual Studies programme complements your main field of study and is awarded with 18 ECTS credits.

The MBF programme is structured in such a way as to ensure that students are able to acquire their basic knowledge in the compulsory courses of the first semester. In the second and third semesters, students select core electives and contextual courses according to their individual preferences and thus determine the orientation of their studies themselves. Like this, the MBF curriculum guarantees utmost flexibility and freedom of choice.

Duration: 1.5 years / 3 semesters (full-time)

Credits: 90 ECTS

The compulsory "MBF Integration Days" last several days and take place at the beginning of September (calendar week 36).

The MBF Integration Days are an exclusive series of sessions which will prepare you for the MBF program and include among others an international team building event and several finance and banking related presentations. You can start your Master's degree only once you have successfully completed the MBF Integration Days.

Throughout the program, students may design their individual curriculum according to their preferences. They can freely combine courses from an extensive list of core electives grouped in the focus areas of Financial Markets, Banking & the Financial Economy, Corporate Finance, Alternative Investments, Risk Management & Insurance and Quantitative Methods & Data Science. It is also possible to obtain a Diploma Supplement in one of the above-mentioned areas, when a student completes at least 12 ECTS and the Master's thesis in the corresponding subject track. The wide selection of courses and the flexibility of the curriculum make the MBF program particularly attractive.

You can find the entire course offering in the official Course Catalogue Online.

Our students have the possibility to concentrate on one subject track during their studies. To receive a Diploma Supplement of Subject Track, the student has to take min. of 12 ECTS in Subject Track + write the Master's thesis in Subject Track. Please note, that the mandatory courses "Financial Markets", "Financial Institutions", and "Quantitative Methods" do not count towards the subject track. However, it is always possible to freely choose and combine courses from different subject tracks. Please note that the Subject Track "Sustainable Finance" is new and therefore only possible for students, who starting their studies in the autumn semester 2024.

Alternative Investments |

|

| ||

|

| |||

Banking & the Financial Economy |

|

| ||

|

| |||

Corporate Finance |

|

| ||

|

| |||

Financial Markets |

|

| ||

|

| |||

Quantitative Methods & Data Science |

|

| ||

|

| |||

Risk Management & Insurance |

|

| ||

|

| |||

Sustainable Finance |

|

| ||

|

|

The research seminar is a 3 ECTS course, available in the spring semester, where the students are required to write a paper with a particular research focus. All groups present and discuss their main findings with the class. In combination with the Master's thesis, the MBF therefore provides a thorough preparation for a Ph.D.

Independent electives create additional choices, where students may either attend further core electives of the MBF or courses of other Master's programs.

You can find the entire course offering in the official Course Catalogue Online.

The MBF programme encourages and enables its students to supplement their academic curriculum with international experience. Double degrees, exchange programmes, students from all over the world, an international faculty, an internationally orientated curriculum and networks built up by the University of St.Gallen give students the opportunity to experience foreign cultures and perspectives at first hand.

Students can pursue double degree programs with leading institutions, including ESADE (Barcelona, Spain), HEC Paris (France), RSM Erasmus University (Rotterdam, Netherlands), and FGV (São Paulo, Brazil). Additionally, through the CEMS Alliance, students can earn a Master in International Management (MIM) alongside their MBF degree, preparing them for global leadership roles. The program also includes Swiss mobility options and over 200 partner universities worldwide for semester exchanges.

Entirely in English (with some elective & contextual courses offered in German)